Certain professionals are worth provided before you can disregard HELOCs once the too expensive or difficult to obtain. While the an investor, we wish to ensure that your possessions is energetic. Money tied up for the a beneficial property’s collateral in accommodations property is unproductive.

And HELOCs merely rates currency if you spend the loans. You can secure the HELOC easily accessible because a resource of cash move if the an investment possibility appears.

And you will, ultimately , the brand new mark several months having HELOCs always continues to ten years, so there’s no quick hurry to invest the bucks. And you don’t need to start settling the new personal line of credit until the mark months comes to an end.

Are there Downsides Off Getting An effective HELOC Towards the Investment property?

Taking right out a good HELOC to the an investment property won’t be brand new best choice for anyone. Because of the chance and you may bills on it, it’s value taking the time to consider whether or not an effective https://paydayloanalabama.com/standing-rock/ HELOC is effectively for you.

Risks of Playing with Money spent Since the Cover For a financial loan

Probably the most significant drawback of taking out good HELOC is the fact you might be putting your home on the line. In this case, you aren’t risking most of your home, however you create chance foreclosing on the leasing assets. If this happens, you’ll clean out your investment and all tomorrow money you would’ve obtained.

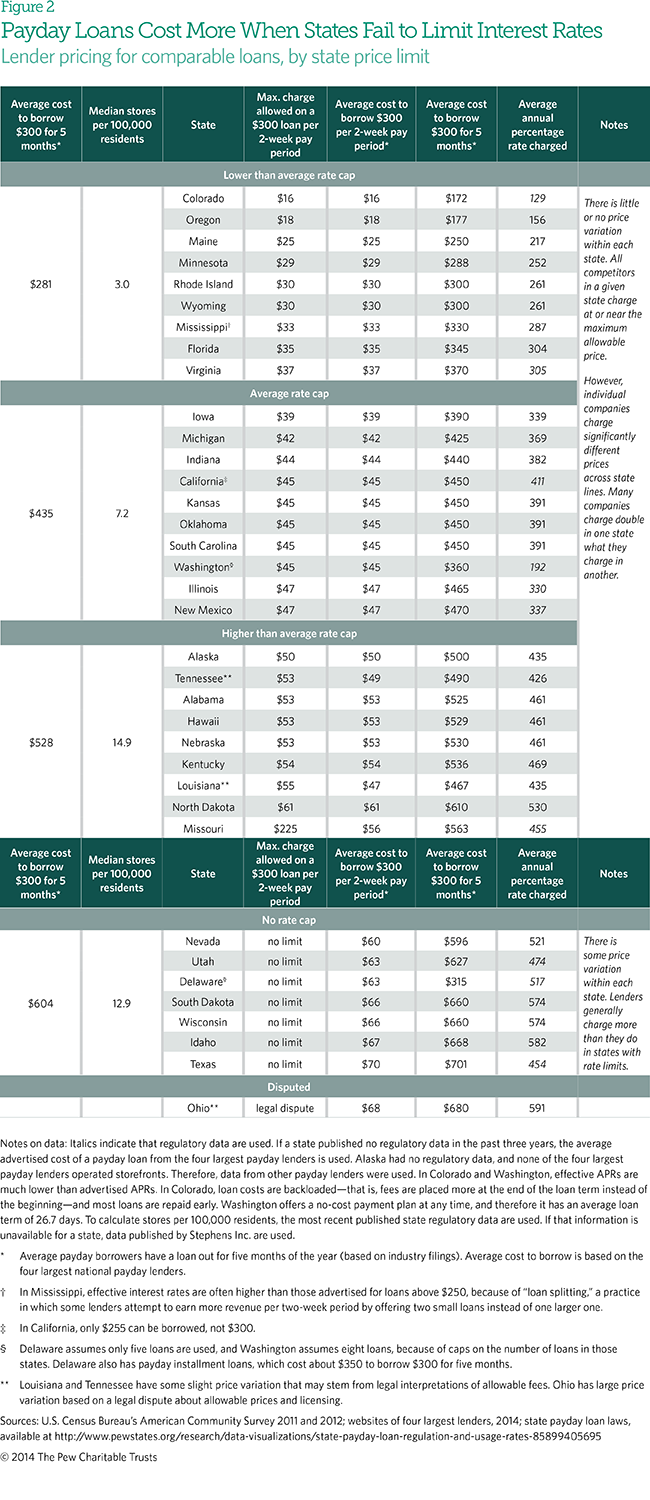

Highest Interest rates

A beneficial HELOC on the an investment property generally speaking is sold with variable desire cost, which can rating high priced immediately. It’s wise to spend close attention so you’re able to exactly how much you might be using into desire.

Have there been Taxation Advantages to Playing with A HELOC On A rental Possessions?

The fresh new Tax Slices and you will Operate Act from 2017 altered lots of the rules to possess saying taxation write-offs on your own mortgage. This means that, specific taxation masters will come that have taking out fully an excellent HELOC on the an investment property.

When you take out a mortgage towards a rental family, you can discount one expenses your obtain since a property owner. Of course, if you’re taking away a good HELOC on that home loan, you might discount part of the attention your repaid on the loan over the past 12 months.

Were there Options So you can HELOCS Into the Leasing Attributes?

If you are not certain that taking out fully a great HELOC toward an effective leasing house is a good choice to you, additional options can be worth considering. Let us glance at three:

- Cash-away re-finance: When you look at the a cash-out re-finance, your refinance their rental possessions on a higher amount borrowed and you will next receive the difference in bucks. The advantage here’s you will likely get a lower speed in the a profit-out re-finance than simply that have a HELOC. Together with, it doesn’t add another payment with the list of expenses. Instead, money is rolling to your newest home loan. And you can spend funds as you pick match.

- HELOC on your own top quarters: Another option is to try to take out a HELOC in your number 1 residence. If in case your meet the requirements, a vintage HELOC is a lot easier to help you qualify for and usually happens which have some down rates of interest.

- Domestic collateral loan: For money spent people with plenty of equity, property guarantee loan are a smart replacement for an excellent HELOC. Using this mortgage, you get a lump-sum fee which you can use to fund repairs or make a crisis percentage. Just like HELOCs, domestic security money aren’t readily available for financial support features and certainly will incorporate high rates.

- Unsecured personal bank loan: You can envision taking right out a keen unsecured personal bank loan. When you take away that loan, you will get a one-time swelling-sum The new investment is fast, and you may strong applicants get qualify for all the way down pricing. But you will must begin making payments straight away.

No responses yet