If you’re in Colorado or the The southern area of, you have likely heard about Places Financial. In fact, you might already feel a financial buyers which have mother company Regions Economic.

The firm was a financial frontrunner in the states off Alabama and you may Tennessee, so if you’re the kind you to definitely likes to do all the providers under one roof, Nations Mortgage was to you.

Besides their good exposure regarding the The southern area of, they also promote banking and you will financial features during the Indiana, Illinois, and Missouri.

Its basic mountain is that you should get the financial regarding a loan provider you can rely on, specifically a giant mil-buck bank with an almost fifty-year records.

Places Mortgage Brief Activities

- In public replaced commercial financial serving users on the Midwest, South, and you may Tx

- Depending when you look at the 1971, headquartered within the Birmingham, Alabama

- One of the largest financial institutions in the usa (ideal 40)

- A leading-fifty home loan company nationally because of the volume

- Funded almost $7 mil during the belongings loans through shopping station through the 2019

- Florida accounted for 25% regarding full mortgage frequency

- In addition to a primary lending company in the states off Alabama and you will Tennessee

The business, which is one of the biggest financial institutions in the usa, are situated for the 1971 that is based inside Birmingham, Alabama.

This past year, it funded nearly $seven billion in home financing, letting them merely sneak to the most readily useful-50 home loan company listing in the united states.

At exactly the same time, it exited the correspondent home loan lending company inside 2018. Making it clear they’ve been entirely worried about originating mortgage brokers thru the brand new merchandising, direct-to-user channel.

Surprisingly, Places also sells house and identify Nations-possessed features on their site. That it would-be a-one-end buy specific homebuyers!

Bringing home financing which have Nations Mortgage

- You can get a mortgage directly from their website or on your own cellular telephone

- It is said it will require from the seven times to accomplish the application form

You could start several various methods. Without a doubt, you could lead down to a brick-and-mortar department if that’s your personal style, or maybe just call them abreast of the phone.

Or you can head to their site and appearance for a financial loan manager in your area. You may require property purchase otherwise mortgage refinance by using the on the internet means.

Of course, if you decide to go the online channel and select a certain financing manager, you might sign up for home financing directly on the website instead one person communications.

Like many digital mortgage software, you will need to join, offer first contact info, after that provide more monetary recommendations such as your income, financial details, a position history, and so on.

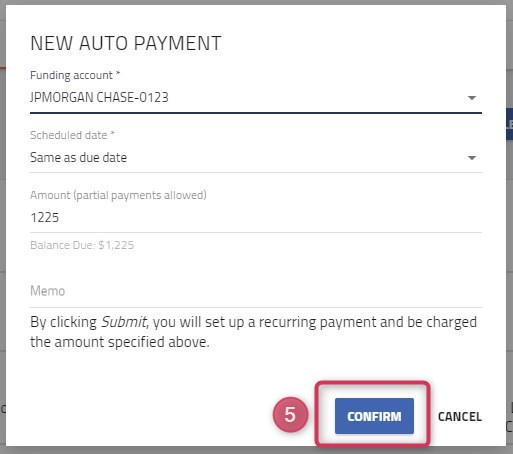

When your financing try filed, you could potentially manage they via the borrower webpage any moment. You’re going to be given a to-manage number and the substitute for located reputation status to remain in the understand.

In general, it seems like a sleek and simple-to-have fun with financial dashboard which should make it rather painless to locate the loan toward finishing line.

If you’re looking having home financing pre-certification, the new Regions Buy Strength unit offers an over-all notion of simply how much it’s also possible to meet the requirements to obtain.

What forms of Mortgage brokers Do Places Home loan Give?

Nations Financial now offers several different version of mortgages, and family buy investment, financial refinances, repair loans, and you will build-to-perm fund.

You can access the brand new security of your house thru a finances aside re-finance or a house security credit line (HELOC).

And you may very first-big date home buyers can enjoy reduced-downpayment software, like the step three% off required by Fannie/Freddie, or even the step three.5% off required by new FHA.

Nevertheless they bring USDA mortgage brokers for those to acquire from inside the outlying parts of The usa, and you can Virtual assistant funds both for energetic duty and experienced homebuyers otherwise present people.

You can purchase a predetermined-price mortgage such as for instance a thirty-season repaired otherwise 15-12 months fixed, otherwise a varying-price home loan for example a beneficial 5/step one or seven/1 Arm.

Those individuals to buy a really costly household or refinancing a more impressive current financing can enjoy its jumbo mortgage products.

Eventually, as they are a beneficial depository financial, they truly are able to render stuff others males can not since they are able to keep they within their financing portfolio than it is to help you promoting it.

Nations Mortgage Prices

But unlike other programs, it take the time to explain why, claiming its because of the lingering fluctuation of mortgage interest levels.

I will agree totally that advertised home loan pricing aren’t value good whole lot, however it is nevertheless nice to see anything.

Put differently, you won’t understand how aggressive he or she is if you do not get in contact and possess a no cost rates quotation.

It indicates we don’t learn their attention cost or charge, and are not appearing giving any coupons in order to existing Places Financial put customers instance different highest banking institutions do.

To conclude, definitely research rates to be certain they offer an effective blend of price and closing costs in accordance with most other banking institutions and you may mortgage lenders.

Nations Home loan Reviews

Its mother or father company, Places Financial Corp., is actually licensed for the Bbb, and has now already been because the 1956. Unclear why more than after they was basically built.

They already take pleasure in a the+ Better business bureau get, that is centered on problems history and how a friends responds in order to said problems.

Discover lots of grievances contrary to the team, but they’re also a large financial and not them pertain to their property credit division.

Nations Financial have good cuatro https://paydayloanalabama.com/fort-payne/.3-superstar rating out 5 to your Trustpilot predicated on to a hundred customers reviews, and that once more aren’t limited to their residence money organization.

They also have a great step 3.9-star score away from 5 towards the WalletHub centered on almost 2,one hundred thousand studies. Once again, you’ll want to comb because of them to get a hold of that really pertain in order to mortgage loans.

The best flow could well be to appear up individual mortgage officer’s feedback who do work at Nations Mortgage on Zillow observe just how a particular personal provides fared previously.

No responses yet